Monthly View - December 2023

November witnessed a dramatic change in investor sentiment. Global share and fixed income markets delivered strong positive returns over the month.

A number of factors drove the sharp bounce in financial markets, chief among them were better than expected inflation data, increased confidence the US Federal Reserve (Fed) has finished raising interest rates, better than forecasted corporate earnings, and growing expectations the US is likely to avoid slipping into a recession. Developments in November pave the way for markets to continue to perform in the months ahead, as is typical when central banks end their hiking cycle and inflation is anticipated to decline. The ongoing resilience of the US economy provides further support for global share markets as we enter the New Year.

There was no change in the US Headline inflation index in October, which was better than the anticipated 0.1% increase. Annual inflation fell to 3.2%, down from 3.7% in September. Softer US labour market data helped reinforce expectations that US inflation pressures are easing and inflation will continue to decline. Jobs growth of 150k in October was less than the 170k anticipated. The US unemployment rate rose to 3.9%, the highest level since January 2022. Importantly, wage growth slowed further. Average hourly earnings increased 0.2% in October, which is considered consistent with a 2.0% inflation rate (the Fed’s target rate of inflation).

US Headline Inflation (YoY)

There is growing evidence globally that central banks are making progress against inflation. European inflation fell to 2.4% year-on-year in November, down from 2.9% in October. Inflation is also falling sharply in the UK. Preliminary New Zealand inflation data was weaker than anticipated, for example food prices fell 0.9% in October.

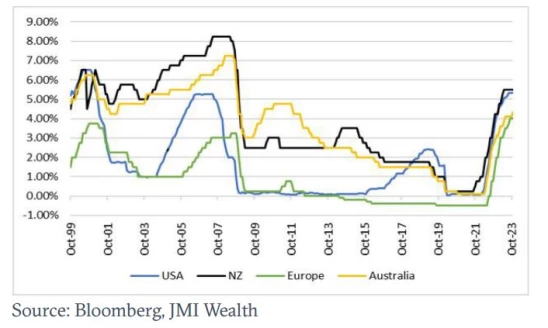

Central banks are hitting the pause button

Better than expected US inflation outcomes and softer labour market data supports the view the Fed has likely finished raising interest rates in this cycle.

At its most recent meeting the Fed left interest rates unchanged for the second consecutive meeting. The Fed noted that the rise in longer-term interest rates had tightened US financial conditions which would help in bringing inflation down towards its 2.0% target. In providing forward guidance, the Fed said they will proceed carefully and that it is appropriate that interest rates remain at current levels for some time. The Fed gave no indication of cutting rates anytime soon.

The European Central Bank (ECB) kept its deposit rate at 4.0% in October, ending a streak of 10 consecutive rate hikes. The Reserve Bank of New Zealand (RBNZ) maintained the Official Cash Rate (OCR) at 5.5% at its November meeting. The RBNZ raised the OCR to 5.5% in May 2023. The RBNZ took a stronger tone on the outlook for interest rates than anticipated, focusing on the upside risks to inflation. Their concern is the upside risk to inflation from the strong net migration New Zealand has experienced over the last twelve months. The RBNZ noted if inflation pressures were to be stronger than forecasted, they would likely need to raise the OCR further. This took investors by surprise.

Global central bank’s cash rates pausing

New Zealand

Although there has been some improvement in business confidence, on the back of a change in government, the domestic economic backdrop remains sluggish. Softness in the labour market and ongoing weakness in the manufacturing sector supports the view that further interest rate hikes by the RBNZ would be unwarranted.

The New Zealand share market1 rose 5.4% in November, primarily driven by offshore events and better-thananticipated corporate earnings updates. Trading updates that surprised to the upside from Mainfreight (+17.9%) and Fisher & Paykel Healthcare (+13.2%) led the market higher.

Australian Share Market

The Australian share market2 rose 5.0% in November on stronger global share markets and falling longer-term interest rates. In contrast to the other major central banks, the Reserve Bank of Australia (RBA) increased their cash rate to 4.35% in November, after being on pause for 4 months. The RBA is anticipated to leave rates at this level for some time.

Financial stocks (CBA +8.0%) and property stocks (Character Hall +20.0%) outperformed benefiting from lower longerterm interest rates. Woodside (-9.5%) and Santos (-9.9%) underperformed, declining due to a fall in the oil price (-6.1%)

Global Share Markets

Global share markets3 rose 8.1% in November and are up 1.4% over the last three months. Share markets rose on growing confidence that inflation will continue to fall, the belief that most major central banks are likely finished hiking interest rates, and the US economy can avoid recession.

A stronger New Zealand dollar in November detracted from global equities returns. In New Zealand dollar terms global equities rose 3.3% over the month. The New Zealand dollar rose 6.1% versus the US dollar in November. The strength in the NZ dollar was more about US dollar weakness as investors moved away from the “safe haven” qualities of the US dollar and were prepared to take on more investment risk.

Conclusion

There was a positive shift in market sentiment in November, which is expected to be maintained as we enter the New Year.

Both fixed income and sharemarkets have benefited from better-than-expected inflation, an easing of US labour market conditions, and a slowing of US economic activity. This backdrop provides support to the view the Fed has likely finished raising interest rates in this cycle.

The outlook for global and domestic fixed income remains attractive despite recent gains. Fixed income offers an attractive yield with the potential for capital gains from further declines in interest rates. Longer term interest rates are forecast to decline over the next twelve months given expectations that inflation will continue to ease, and central banks have finished raising interest rates.

Stability in longer-term interest rate markets and an ending of interest rate hikes by central banks would be positive for global equity markets. Although US economic activity is expected to slow from its robust pace earlier in the year, the prospects for the US economy have improved in recent months. Against this backdrop, and in the absence of a recession, global sharemarkets are likely to continue to build on their recent gains.

Focusing on your long-term goals while acknowledging that in the short-term, returns may be volatile, should reward investors.

1 S&P NZX 50 gross index

2 S&P ASX 200 total return Index

3 MSCI ACWI Index in local currencies

Allocation to long-term benchmarks

| Sector | Position | Content |

| Cash | Underweight / Neutral |

Preference for fixed income |

| New Zealand fixed interest |

Overweight | Longer-term interest rates are offering attractive yields and domestic economic data is softening supports a constructive view on New Zealand fixed income. |

| International fixed interest |

Overweight | Longer-term interest rates are offering attractive yields. Global economic activity is weak, global inflation is peaking, and central banks are nearing the end of interest rate hiking cycles. |

| Australasian shares | Neutral/ Underweight |

Slight underweight New Zealand, slight overweight Australia. |

| International shares | Overweight | The economic environment has become more balanced, given the improved outlook for the US economy. The expected ongoing decline in inflation and the end of central banks hiking interest rates is also positive for international sharemarkets. Valuations have improved. |

| Property | Underweight | Underweight on high short-term interest rates and economic pressures on dividend yields. |

Indices for Key Markets

| As at 30 November 2023 | 1 Mth | 3 Mth | 1 Yr | 3 Yrs p.a. | 5 Yrs p.a. |

| S&P/NZX 50 Index | 5.4% | -1.5% | -1.0% | -3.2% | 5.9% |

| S&P/ASX 200 Accumulation Index (AUD) | 5.0% | -1.8% | 1.5% | 7.1% | 8.7% |

| MSCI ACWI Index (Local Currency) | 8.1% | 1.4% | 11.3% | 7.2% | 9.7% |

| MSCI ACWI Index (NZD) | 3.3% | -1.8% | 13.5% | 10.5% | 11.5% |

| S&P/NZX 90 Day Bank Bill Total Return | 0.5% | 1.4% | 5.3% | 2.5% | 2.0% |

If you have any questions please contact us on +64 9 308 1450

Information and Disclaimer: This report is for information purposes only. It does not take into account your investment needs or personal circumstances and so is not intended to be viewed as investment or financial advice. Should you require financial advice you should always speak to your Financial Adviser. This report has been prepared from published information and other sources believed to be reliable, accurate and complete at the time of preparation. While every effort has been made to ensure accuracy neither JMI Wealth, nor any person involved in this publication, accept any liability for any errors or omission, nor accepts liability for loss or damage as a result of any reliance on the information presented.