Monthly View - August 2024

Global markets moved higher in July

July witnessed several market moving events leading to high levels of volatility. Except for large cap US technology companies, which declined in value over the month, the volatility was generally to the positive side with both fixed income and equity markets delivering positive returns. Events over July included a surprise French election result, dramatic developments in the US presidential race which ultimately led to the withdrawal of President Biden in the race for the White House, and important policy pivots by the US Federal Reserve (Fed) and Reserve Bank of New Zealand (RBNZ).

Global Equities

The epicenter of the shift in investor sentiment in July was US smaller companies. As can be seen in the graph below, US small cap companies (as measured by the Russell 2000 Index) significantly outperformed US large companies (represented by the S&P 500 Index) in July. For the month, the Russell 2000 Index returned 10.1%. This gain largely came over a seven-day period, which resulted in smaller companies outperforming larger companies by the largest margin since the establishment of the Russell 2000 Index in 1986.

The graph above also highlights that the S&P 500 Index reached new historical highs early in the month. The Index fell from these highs as investors rotated out of large technology companies and into smaller companies. The technology heavy Nasdaq index fell 1.6% in July and would have been lower if not for a 13% rise in the value of Nvidia on the last day of the month. Nvidia’s gain saw its market value increase by US$329 billion, the biggest one-day dollar value increase for any company in history.

One catalyst for the market movements in July was the rising popularity of Donald Trump. This followed the poor showing by President Biden at the first Presidential debate in late June and the failed assassination attempt on Trump. This led to the so-called Trump trade, which favours buying stocks and pivoting toward smaller, domestically orientated firms and “old economy” industries at the expense of large technology companies. This reflects the potential policy mix of Trump including corporate tax cuts (seen to benefit the stock market overall) and introduction of tariffs that would benefit domestic manufacturers and likely hurt technology companies’ earnings on rising costs.

Another trigger to the market rotation was encouraging inflation data. US prices rose 3.0% over the year ending 30 June 2024. This is down on the annual pace of 3.3% in May and below expectations of 3.1%. The benign inflation data and further evidence of softness in the US labour market underpinned expectations that the Fed can begin cutting interest rates earlier than anticipated. Lower interest rates tend to boost sharemarkets on a six-to-twelve-month view, assuming recession is avoided.

US second quarter earnings announcements commenced in July. At month’s end 75% of companies had provided earnings updates, of these 78% had reported positive surprises. The focus has been on the large US technology companies given their strong outperformance since the beginning of the year. Amongst these companies the results have been mixed and a little disappointing in aggregate. Meta (who owns Facebook) announced earnings that beat expectations. Microsoft’s earnings announcement disappointed on concerns over momentum in their cloud business and worries about the amount of capital they are spending on AI-related projects. Amazon missed its earnings estimates.

Global sharemarkets rose [1] 1.2% in June and are up 18.4% over the last twelve months.

In New Zealand dollar terms global equities returned 4.2% over the month because of a weaker New Zealand dollar boosting returns from offshore assets. The New Zealand dollar fell against most major currencies in July on the pivot by the RBNZ, softer than anticipated inflation data, and ongoing weakness in the domestic economy (see comments below under Fixed Income and cash markets).

Australasian Equities

Over the month New Zealand’s share market [2] rose 5.9% supported by the Reserve Bank of New Zealand (RBNZ) indicating interest rate reductions are now likely to occur sooner than previously forecasted. The local market also benefited from corporate activity with private equity firms making takeover offers for retirement village operator Arvida Group and retailer The Warehouse (which has subsequently been withdrawn).

Arvida rose 74% over the month, other listed retirement village operators benefited from the announcement. Over the month Oceania, Ryman Healthcare, and Summerset rose 47%, 27%, and 18% respectively.

Australian equities also performed strongly, gaining 4.6% [3] in July. The market benefited from a better-than-expected inflation outcome removing the likelihood of interest rate increases. James Hardie performed well, rising 8.0% on a positive outlook for the US housing market. The banks continued to perform well with the Commonwealth Bank reaching a new high during the month. Interest rate sensitivity sectors such as property performed well on the change in interest rate expectations. Property companies Vicinity Centres and Mirvac Group both rose 14%. Commodity related companies, such as Rio Tinto (-1.3%), underperformed the market on softer commodity prices. The Bloomberg Commodity Index fell 4.0% in July, primarily on the continuation of weak Chinese economic data.

Fixed income and cash markets

Global bond yields continued to decline in July on a pivot by the Fed, benign US inflation data, and in anticipation of further interest rate reductions by central banks around the world. The US 10-year government bond yield fell 37 basis points (0.37%) to 4.03% over the month. The Bloomberg Global Aggregate Bond Index (New Zealand dollar hedged) returned 2.0% in July.

Benign inflation data and further evidence of softness in the US labour market has underpinned expectations that the Fed can begin cutting interest rates earlier than anticipated. In its most recent update, the Fed indicated that interest rate cuts could come as soon as September this year. In a shift in tone the Fed has recognised the growing risks to the US labour market. The Fed is increasingly acknowledging the balance between ensuring inflation comes back to the Fed’s 2.0% target and preventing a sharp and unnecessary rise in the unemployment rate.

New Zealand’s longer-term interest rates drifted lower on global events and ongoing weakness in domestic economic data. The local fixed income market [4] rose 2.3% for the month.

Although the RBNZ kept the Official Cash Rate (OCR) at 5.50%, as widely expected, there was a clear softening in their tone as to the outlook for the OCR. Unlike their last update, a rate hike was not discussed, the Bank acknowledged that economic activity had slowed more than anticipated, and that high interest rates had “significantly reduced consumer prices”.

New Zealand’s annual rate of inflation eased to 3.3% over the June quarter, down from 4.0% for the first quarter and lower than the 3.6% forecast by the RBNZ.

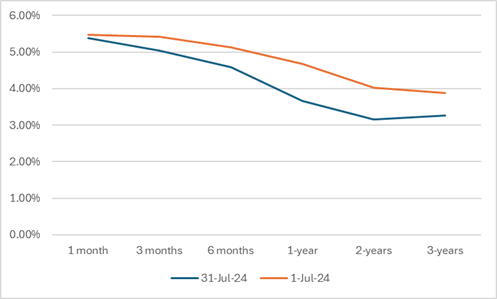

The pivot by the RBNZ, easing of inflation and ongoing weakness in local economic data resulted in a dramatic change in expectations as to when the RBNZ will cut interest rates and by how much.

This is highlighted in the graph below which compares market expectations for future levels of the OCR forecasted at the beginning and end of July. By way of example, on the 1st of July the market anticipated the OCR would be at 4.7% in one year’s time, down from 5.5% currently. By the end of the month, the OCR was forecasted to fall to 3.7% in a year’s time, a full 1.0% lower than anticipated on 1 July.

Implied OCR

Conclusion

Fixed income offers stability of income and the potential for capital gains from further declines in interest rates. Longer term interest rates are forecasted to decline over the next twelve months, given expectations that inflation will continue to ease and that central banks will commence interest rate reductions. This is positive for both domestic and international fixed income.

With the US labour market clearly softening the risks of recession have risen. However, at this stage this appears to be a continued normalising of the US labour market and the economy remains on track for a soft landing. Market volatility, as we have experienced recently, can be expected at the time of Fed policy pivoting, given increased economic uncertainty. This has also come after a period of strong gains from global shares and some short-term weakness would not surprise. On a longer-term view, a reduction in interest rates will be positive for global sharemarkets.

In this environment, we recommend investors to continue to focus on their long-term goals while acknowledging that in the short-term returns may be volatile. In time, this approach should reward investors.

1 MSCI ACWI Index in local currencies

2 S&P NZX 50 gross index

3 S&P ASX 200 total return Index

4 Bloomberg NZ Bond Composite 0+ Yr Index

Indices for Key Markets

| As at 31 July 2024 | 1 Month | 3 Months | 6 Months | 1 Year | 3 Years p.a. | 5 Years p.a. |

| S&P/NZX 50 Index | 5.9% | 3.9% | 4.9% | 3.8% | 0.3% | 3.5% |

| S&P/ASX 200 Index (AUD) | 4.2% | 6.2% | 7.3% | 13.5% | 7.4% | 7.5% |

| MSCI ACWI Index (Local Currency) | 1.2% | 7.6% | 13.1% | 18.4% | 7.4% | 11.8% |

| MSCI ACWI Index (NZD) | 4.2% | 7.4% | 16.1% | 22.5% | 11.5% | 13.4% |

| S&P/NZX 90 Day bank bill Total Return | 0.5% | 1.4% | 2.8% | 5.8% | 3.7% | 2.5% |

If you have any questions please contact us on +64 9 308 1450

Information and Disclaimer: This report is for information purposes only. It does not take into account your investment needs or personal circumstances and so is not intended to be viewed as investment or financial advice. Should you require financial advice you should always speak to your Financial Adviser. This report has been prepared from published information and other sources believed to be reliable, accurate and complete at the time of preparation. While every effort has been made to ensure accuracy neither JMI Wealth, nor any person involved in this publication, accept any liability for any errors or omission, nor accepts liability for loss or damage as a result of any reliance on the information presented.