Monthly View - April 2024

Global share markets reach historical highs

March rounded out a strong start to 2024 for global financial markets. The US S&P 500 index rose 3.2% in March, resulting in a quarterly gain of 10.6%, its best start to a year since 2019. The S&P 500 is 23.5% higher than six months ago, in dollar terms this is equal to a US$19 trillion gain in market value.

The resilience of the US economy, robust corporate profits, enthusiasm around artificial intelligence (AI), and the prospect of central banks reducing interest rates later in the year have pushed global markets higher.

Against this backdrop, global share markets [1] returned 3.4% in March and are up 9.5% since the beginning of the year. Share market indices in the US, Europe, Japan, and Australia reached historical highs during March.

Global Equities

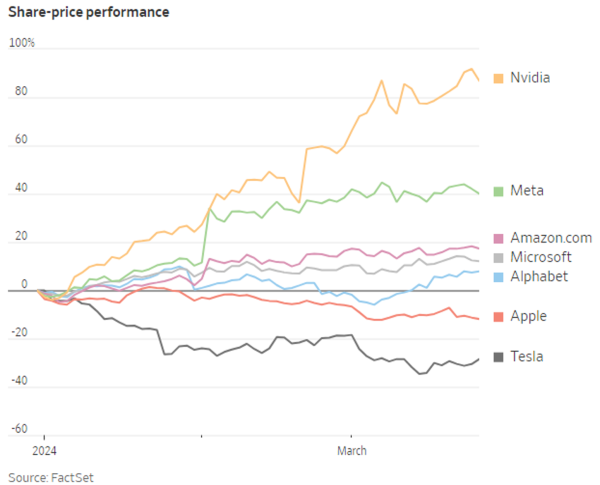

Performance earlier in the year was driven by the large US technology companies, such as computer chip manufacturer Nvidia, as they reported better-than expected profit results. As the corporate profit season came to an end in late February, investors focussed on a broader universe of companies supported by the ongoing growth in the US economy.

Accordingly, performance has been strong beyond America’s largest companies (as measured by the S&P 500), with the US small-cap Russell 2000 index climbing 9.6% since the beginning of the year. Along with tech giants Nvidia and Meta (Facebook), a diverse group of companies reached all-time highs during the month, including Walmart, Colgate-Palmolive, American Express, JP Morgan, and Caterpillar.

There has however been a divergence in performance amongst the larger US technology companies, with Tesla and Apple underperforming more recently.

Source: WSJ

Of those companies continuing to report earnings updates some key themes remained. The hype around AI continues. Dell Technologies surged 31% after reporting better-than-expected sales and earnings on the back of rising demand for its AI servers. Although Dell was cautious on the outlook for the broader US economy, they see AI demand remaining strong. Some areas of the US economy are struggling, particularly retail as higher interest rates and rising costs of living bite into discretionary spending. There was weakness in retailers Foot Locker and luxury department store Nordstrom after they flagged weaker than anticipated sales results.

Across the Atlantic, in contrast to the US experience, Spanish company Inditex, the owner of retailer Zara, hit all-time highs after sales and net income reached record levels. Shares in Europe’s largest company by market value, Novo Nordisk, jumped following its profit announcement which included positive trial results for its obesity drug amycretin. The company continues to see strong demand for its flagship Wegovy and Ozempic anti-obesity drugs. Although designed to treat diabetes, somewhat worryingly these drugs have gained attention as celebrities including Kim Kardashian, tech mogul Elon Musk, and TikTok influencers have described taking them to lose weight in short time frames. US company Eli Lilly has also benefited from the current global weight loss craze.

Australasian Equities

New Zealand’s share market [2] gained 3.3% in March, primarily on positive global investment sentiment and lower longer term interest rates.

Longer-term interest rates fell partly because of weaker than expected economic growth over the last quarter of 2023. New Zealand’s economy shrank -0.1% over the final three months of 2023. This followed a reduction of -0.3% in the third quarter of last year. The New Zealand economy contracted -0.3% in 2023 and has recorded negative growth in four of the last five quarters.

Corporate news was thin during the month given most companies provided profit updates in February. Corporate updates from retailers Briscoe and KMD Brands (Kathmandu) reflected the weakness in the domestic economy. KDM reached historical lows after it flagged half-year sales fell 14.5% from a year ago. On the positive side, The Warehouse was one of the better performing stocks in March (+16.5%) after it signalled it intends to sell or close online platform The Market. This follows the sale of Torpedo7 as the Warehouse narrows its focus on the more profitable parts of its business.

Australian equities rose 3.3% [3] in March for similar reasons to New Zealand and on signs of the ongoing resilience of the Australian economy. In this environment banks have performed well; CBA reached historical highs and NAB its highest level since the global financial crisis. Supporting the performance of banks has been better than expected bad debt levels and provisions. The banks have also been supported by the anticipation of interest rate reductions providing mortgage holders relief.

Gold stocks performed well over the month, Newmont rising 16.8%, benefiting from a historical high gold price. Several factors are underpinning a higher gold price, including central bank buying as they look to diversify away from holding US dollars, rising concerns over geopolitical conflicts in the Middle East and Eastern Europe, and in anticipation of the US Federal Reserve (Fed) cutting interest rates.

Fixed income and cash markets

Global bond yields drifted lower in March on the expectations of central banks cutting interest rates and that the downward trend in inflation is well established, despite bumps along the way. The Bloomberg Global Aggregate Bond Index (New Zealand dollar hedged) rose 0.9% in March.

New Zealand’s longer-term interest rates drifted lower on global events, soft domestic economic data, and an update from the Reserve Bank of New Zealand ruling out the need to raise interest rates as proposed by a local bank’s economist. The local fixed income market [4] returned 1.1% for the month.

Both fixed income and share markets are intently focussed on inflation outcomes and the next move by central banks. Overall, the trend in inflation is down globally but remains too high for an imminent reduction in interest rates. This is the case in most developed countries, including the US, Australia, New Zealand, across Europe, and the U.K.

Reflecting the current stage in the interest rate cycle, the future actions of central banks are very data dependent. Central banks have left short term interest rates at their current levels for some time. The next moves are likely to be down, with the Fed, European Central Bank and Bank of England all expected to begin cutting interest rates over the second half of this year. New Zealand and Australian may join this group in cutting rates late in the year.

In a momentous event for global fixed income markets, the Bank of Japan (BOJ) raised interest rates for the first time since 2007, becoming the last central bank to exit negative interest rate policy. The BOJ shifted the new overnight policy rate to 0.0 – 0.1%. The BOJ Governor, Kazuo Ueda, noted “Extraordinary easing is over”.

The move by the BOJ is a further sign global interest rate markets are normalising and indicates that interest rates will remain higher than were experienced over the decade prior to 2022. This outcome is anticipated to assist the traditional balanced fund as it will benefit from higher yielding fixed income allocations.

Conclusion

The global economic and market environment remains constructive for both fixed income and share markets. Investment sentiment remains positive, inflation is anticipated to continue to decline over the year, central banks have paused raising rates, and their next move is likely to cut, the US economy remains resilient, and the risk of US recession has faded.

The outlook for global and domestic fixed income remains attractive. Fixed income offers an attractive yield with the potential for capital gains from further declines in interest rates. Longer term interest rates are forecast to decline over the next twelve months, given expectations that inflation will continue to ease and that central banks will commence interest rate reductions. In this environment, short dated fixed term securities, such as Term Deposits, are likely to underperform longer-dated securities.

The combination of stability in longer-term interest rate markets and central banks cutting policy rates should be positive for global share markets. Although US economic activity is expected to slow from its robust pace during 2023, the prospects for the US economy have improved in recent months. Against this backdrop, and in the absence of US recession, the outlook for global share markets is positive, with better value seen outside of the US.

Focusing on your long-term goals while acknowledging that in the short-term, returns may be volatile, should reward investors.

1 MSCI ACWI Index in local currencies

2 S&P NZX 50 gross index

3 S&P ASX 200 total return Index

4 Bloomberg NZ Bond Composite 0+ Yr Index

Indices for Key Markets

| As at 31 March 2024 | 1 Month | 3 Months | 6 Months | 1 Year | 3 Years p.a. | 5 Years p.a. |

| S&P/NZX 50 Index | 3.3% | 3.1% | 7.6% | 2.7% | -0.4% | 5.0% |

| S&P/ASX 200 Index (AUD) | 3.3% | 5.3% | 14.2% | 14.4% | 9.6% | 9.2% |

| MSCI ACWI Index (Local Currency) | 3.4% | 9.5% | 19.8% | 24.4% | 8.5% | 11.7% |

| MSCI ACWI Index (NZD) | 4.9% | 14.7% | 20.6% | 29.1% | 12.7% | 13.8% |

| S&P/NZX 90 Day bank bill Total Return | 0.5% | 1.4% | 2.9% | 5.7% | 3.1% | 2.2% |

If you have any questions please contact us on +64 9 308 1450

Information and Disclaimer: This report is for information purposes only. It does not take into account your investment needs or personal circumstances and so is not intended to be viewed as investment or financial advice. Should you require financial advice you should always speak to your Financial Adviser. This report has been prepared from published information and other sources believed to be reliable, accurate and complete at the time of preparation. While every effort has been made to ensure accuracy neither JMI Wealth, nor any person involved in this publication, accept any liability for any errors or omission, nor accepts liability for loss or damage as a result of any reliance on the information presented.