Our Funds

To help you better understand the difference between our funds, we explain below what income and growth assets are.

What are income assets?

Cash and fixed interest (or bond) securities are referred to as income assets because they generate income in the form of interest payments. Income assets are generally considered less volatile than growth assets, so while the values will go up and down, they won’t usually move to the same extent as growth assets. Over the long term, income assets will typically provide lower returns than growth assets.

What are growth assets?

Shares and listed property are referred to as growth assets because they have greater potential to achieve capital growth over the medium to long term when compared to income assets. The value of growth assets will fluctuate more than income assets. Over the long term, growth assets typically provide higher but more volatile returns than income assets.

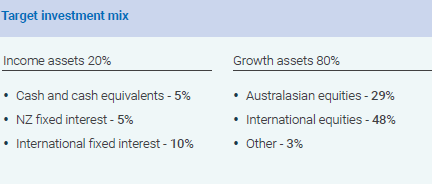

Growth Fund

Aims to provide a high level of capital growth over the medium to long term (at least 7 years). The fund invests mostly in growth assets, with a modest allocation to income assets.

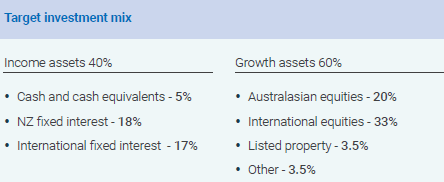

Balanced Fund

Aims to provide a medium level of capital growth over the medium to long term (at least 5 years). The fund invests similar proportions in income and growth assets.

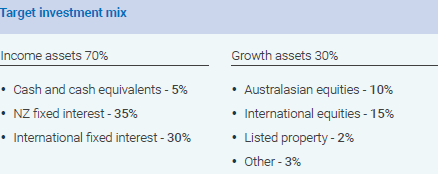

Conservative Fund

Aims to protect capital and provide a moderate return over the medium term (at least 3 years). The fund invests mostly in income assets, with a modest allocation to growth assets.

Finding the right fund for you

Choosing the right fund to invest in is an important decision. It may be affected by a few things particular to you, such as:

- how long before you retire

- whether you are saving for a first home

- what is your appetite for risk.

To help you with this decision below is a simple questionnaire from Sorted that will help you choose.

Need financial advice?

If you would like advice about the JMI Wealth KiwiSaver Scheme, talk to your financial adviser. For help finding a financial adviser, contact us.